Comprehensive check fraud prevention

Reduce check fraud losses and increase operational efficiency with SQNs check fraud solution designed to protect banks from the increasing & evolving check fraud threats

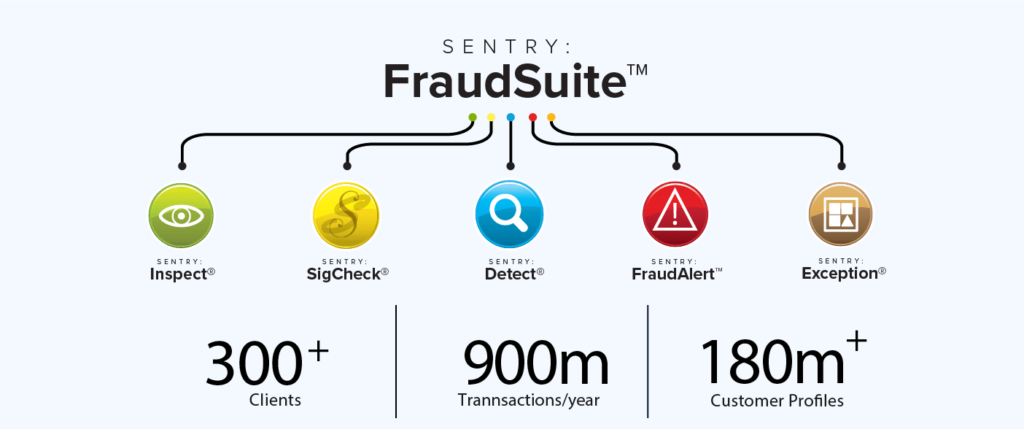

Protect Your Bank from Check Fraud with SENTRY: FraudSuite

SENTRY:FraudSuite™ integrates various check-fraud measures into a comprehensive platform, ensuring security and significant cost savings. SENTRY: FraudSuite™ detects on-us and transit fraudulent checks by building profiles for the FIs customers and using deposit transactions to detect anomalies. By leveraging the power of machine learning, it gathers and analyzes a wide array of transactional, behavioral, and historical data, including image analysis metrics. This comprehensive view of customers and their activities enables the system to identify patterns, anomalies, and potential fraud indicators with a high degree of accuracy.

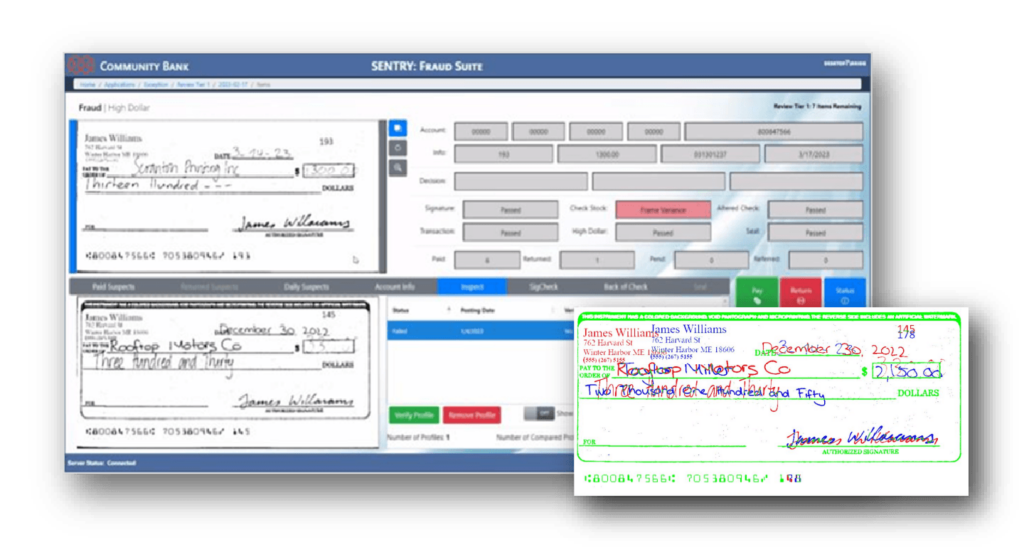

Check Image Analysis

Machine learning image based engine

SENTRY: Inspect™ compares new checks to

the customer profile and looks for anomalies. Everything that is printed on the check is checked for anomalies to look for counterfeit checks.

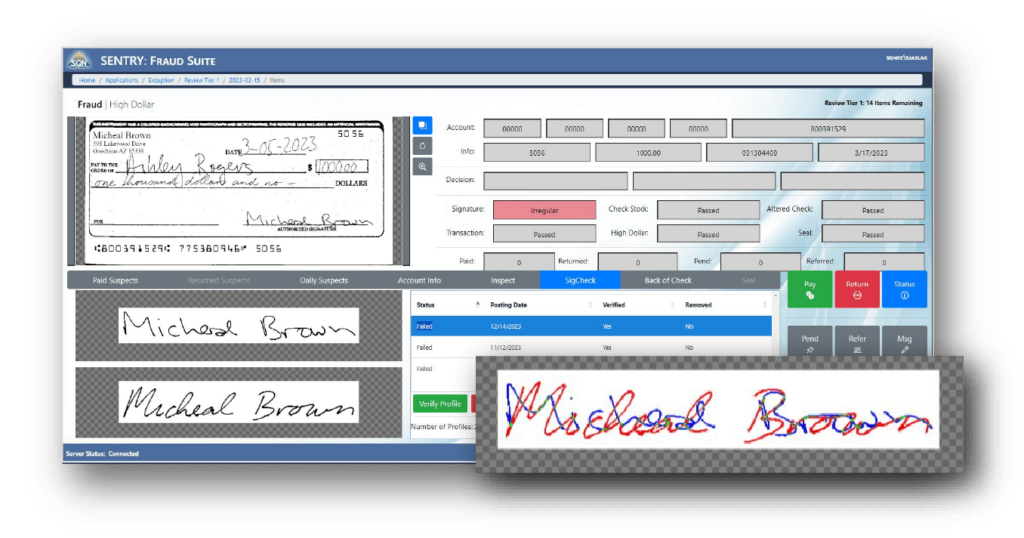

Signature Verification

SENTRY:FraudSuite™ compares signatures to

previously verified checks and alerts for fraudulent or forged activity. It adapts to changes in customer signatures over time and evaluates multiple signatures per account, ensuring comprehensive and accurate verification.

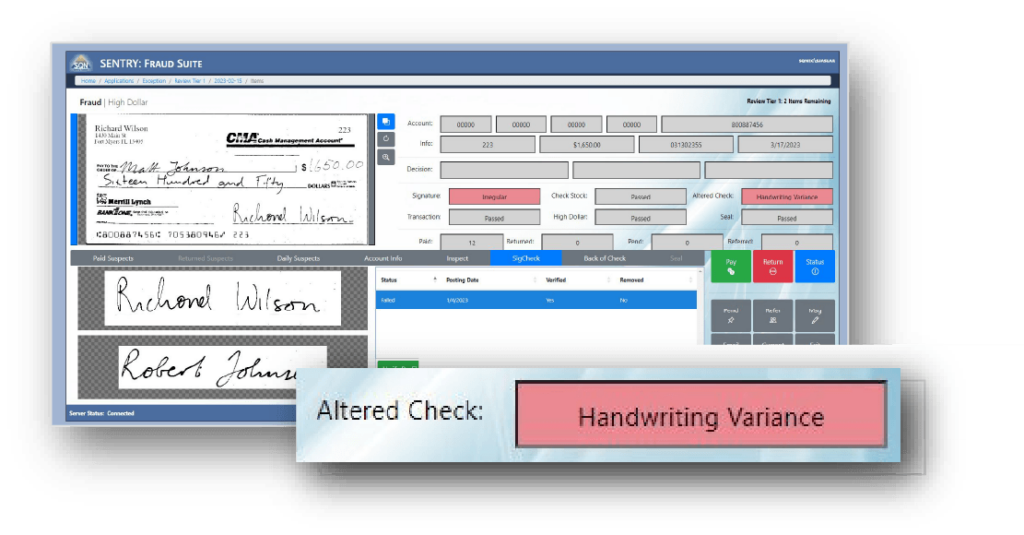

Handwriting Variance Detection

Handwritten elements on checks are analyzed using our AI-driven handwriting profiling technology to detect alterations. This includes identifying mismatched payee names, amounts, or dates that have been modified after the check was issued indicating an altered check.

Defend against the various types of check fraud

Altered Checks

Detect and prevent tampering with check details, such as changes to the payee’s name or amount, ensuring your checks remain secure.

Counterfeit Checks

By analyzing security features and check stockpatterns, SENTRY:FraudSuite™ identifies and stops counterfeit checks from being cashed or deposited.

Forged Checks

Compares signatures to known good signatures on the account to defend against forgeries

Duplicate Checks

Block attempts to cash or deposit the same check multiple times, safeguarding your account from unauthorized withdrawals.

Check Kiting

Protect against non “on-us” check fraud by analyzing account behavioral anomalies, Account open time, and # of checks deposited.

Check Deposits

SENTRY:FraudSuite™ flags and prevents fraudulent transactions involving checks written on closed or empty accounts.

Downloadables

Check Fraud Solution Brochure

Find out how SENTRY:FraudSuite can help reduce check fraud losses for you financial institution.

Complete Guide to Check Fraud

How to Identify Different Types of Check Fraud Before It Harms Your Bank

Case Study: Guranty Bank of Lousianna

Find out how community bank Guaranty Bank in Louisiana used FraudSuite to…