Fraud Protection You Can trust

Using sophisticated algorithms and real-time detection solutions, we help our clients effectively prevent check fraud and payments fraud.

Our Solutions

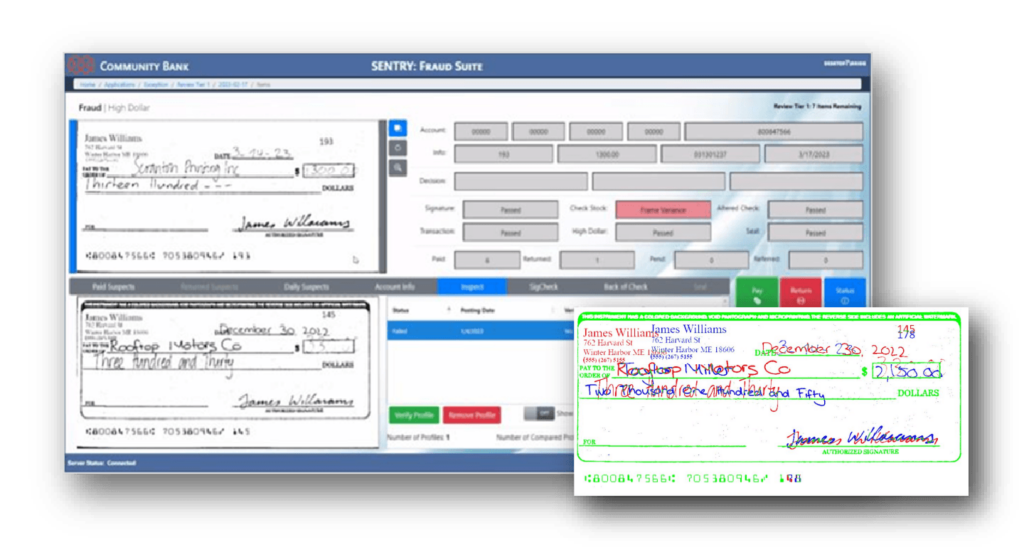

Check Fraud Prevention Platform

SENTRY: FraudSuite™ is our check fraud detection platform that uses machine learning and image analysis to identify fraudulent checks in real time. It helps banks prevent losses, streamline fraud investigations, and enhance security across all check processing channels.

Intelligent Check Data Extraction

SENTRY: CheckInsight™ is an advanced SDK that utilizes OCR technology to extract and digitize check data with precision. Designed for seamless integration into banking systems, it captures key check elements—payee, payer, amounts, MICR, signatures, and more—helping financial institutions automate manual processes, enhance fraud detection, and improve compliance.

Safe Deposit Box Management System

SENTRY: SafeDeposit™ digitizes the entire safe deposit box process, transforming how banks manage and monitor customer access. From account setup to access tracking and audit reporting, the solution automates and streamlines every step, enhancing security and compliance. By eliminating manual record-keeping and paper processes, our system improves operational efficiency, reduces risk, and ensures a seamless, secure experience for both banks and their customers.

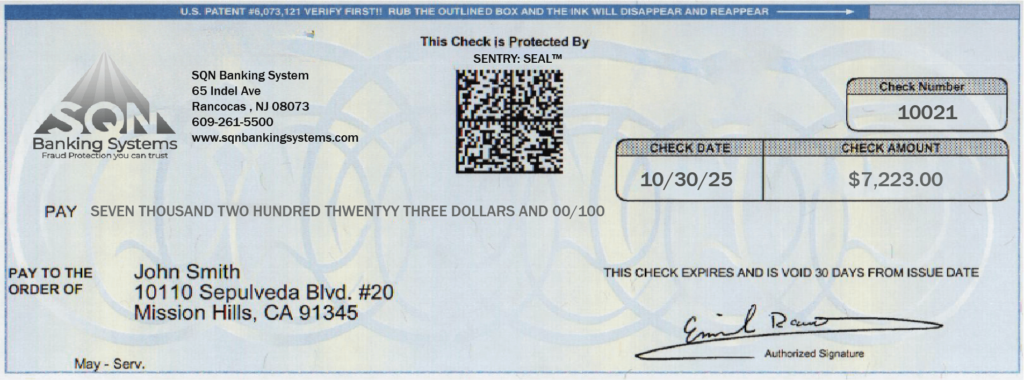

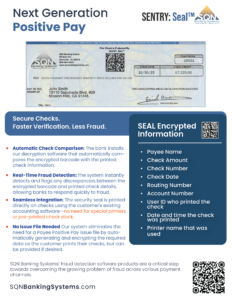

Digital Check Encryption Seal

SENTRY: Seal™ enhances check security by embedding a digital seal on check images, ensuring authenticity and preventing fraud. It detects alterations instantly, integrates seamlessly with SENTRY: FraudSuite, and supports regulatory compliance—helping banks protect against check manipulation.

Positive Payee Validate

SENTRY: Positive Payee Validate™ uses OCR technology to read images of pre-printed business checks and compare the extracted payee names against the payee details in the issued check file. This verification process detects payee alterations before checks are processed, helping financial institutions prevent fraud in real time.

Proven Fraud Detection

300+

Clients

1+ Billion

Transactions/year

180 Million

Customer Profiles

“The response we got back from these particular customers is overwhelmingly positive – they were appreciative of the fact that we actually called them about their check. It’s been a great customer service tool.”

—

Troy Richards, CEO of Guaranty Bank

Downloadables

Check Fraud Solution Brochure

Find out how SENTRY:FraudSuite can help reduce check fraud losses for you financial institution.

Complete Guide to Check Fraud

How to Identify Different Types of Check Fraud Before It Harms Your Bank

Safe Deposit Box Mangaement Brochure

Completely digitze the safe deposit box process to streamline operations and and enhance security measures.

Positive Pay Next Generation Brochure

Protect commercial accounts with SENTRY: SEAL

How Can We Help Your FI?

Share a few details and our team of fraud experts will be in touch shortly!