Our Solutions

Discover our complete range of fraud detection and prevention tools built to safeguard every transaction across your bank’s operations.

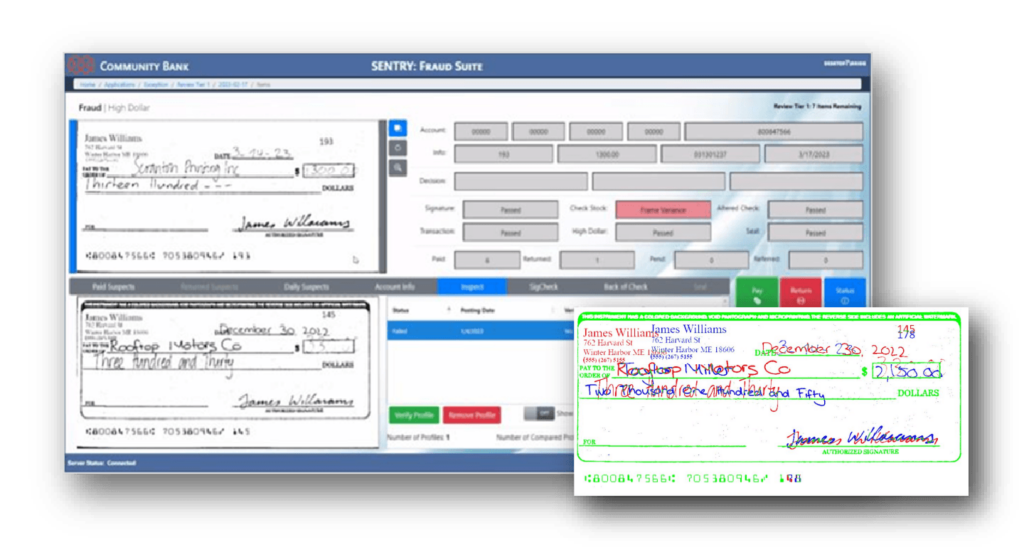

Check Fraud Prevention Platform

SENTRY: FraudSuite™ is our check fraud detection platform that uses machine learning and image analysis to identify fraudulent checks in real time. It helps banks prevent losses, streamline fraud investigations, and enhance security across all check processing channels.

Intelligent Check Data Extraction

SENTRY: CheckInsight™ is an advanced SDK that utilizes OCR technology to extract and digitize check data with precision. Designed for seamless integration into banking systems, it captures key check elements—payee, payer, amounts, MICR, signatures, and more—helping financial institutions automate manual processes, enhance fraud detection, and improve compliance.

Safe Deposit Box Management System

SENTRY: SafeDeposit™ digitizes the entire safe deposit box process, transforming how banks manage and monitor customer access. From account setup to access tracking and audit reporting, the solution automates and streamlines every step, enhancing security and compliance. By eliminating manual record-keeping and paper processes, our system improves operational efficiency, reduces risk, and ensures a seamless, secure experience for both banks and their customers.

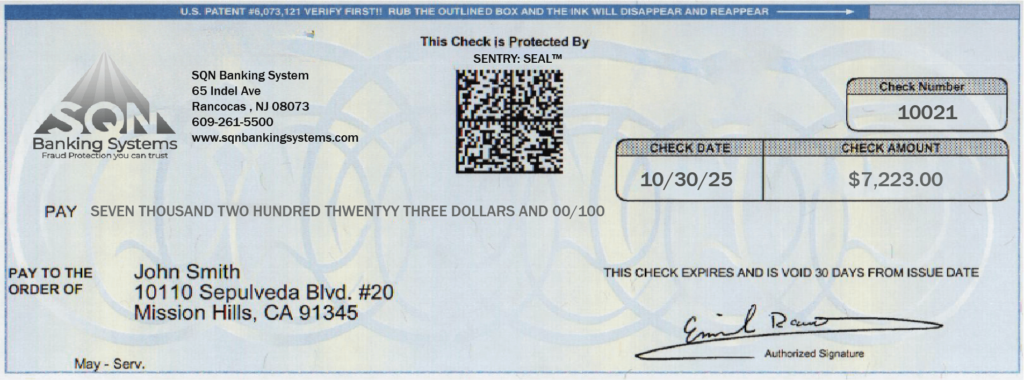

Digital Check Encryption Seal

SENTRY: Seal™ enhances check security by embedding a digital seal on check images, ensuring authenticity and preventing fraud. It detects alterations instantly, integrates seamlessly with SENTRY: FraudSuite, and supports regulatory compliance—helping banks protect against check manipulation.

Positive Pay

SENTRY: Positive Pay™ uses OCR technology to read images of pre-printed business checks and compare the extracted payee names against the payee details in the issued check file. This verification process detects payee alterations before checks are processed, helping financial institutions prevent fraud in real time.