Digital Check Encryption: The Future of Commercial Check Fraud Prevention

We know—you’re tired of hearing about check fraud. It sounds like an old problem that should’ve died off by now. But in the world of commercial payments, it’s not just alive—it’s thriving. Nearly 75% of businesses continue using paper checks for day-to-day operations. And that reliance has a cost. Between 2021 and 2024, check-related suspicious activity reports (SARs) nearly doubled, from around 350,000 to over 682,000. Commercial accounts are the biggest targets, and the fraud isn’t slowing down. Legacy systems like Positive Pay help, but they weren’t built for the scale or speed of modern threats. To truly protect business payments, we need something smarter. That’s where digital check encryption comes in.

What Is Digital Check Encryption?

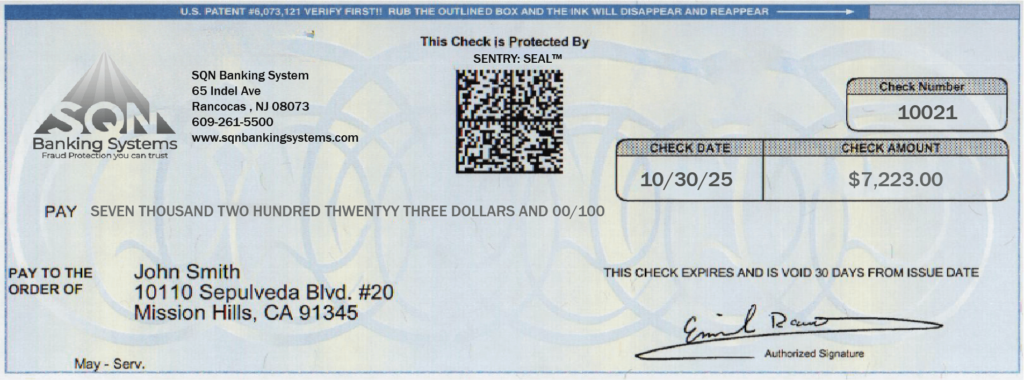

Digital check encryption is a next-generation fraud prevention technology designed specifically for commercial checking accounts. At the time a commercial check is printed, an encrypted barcode, what we at SQN call a Seal, is printed directly on the check. That barcode holds all of the critical details: payee name, amount, date, memo, and more.

When the check is eventually deposited, the bank’s system automatically compares the information stored in the encrypted Seal against the information on the presented check image. If any detail has been altered, the check is flagged as potentially fraudulent and can be returned or held for review.

Additionally, the barcode stores audit data like who printed the check, when it was printed, and which printer was used. That kind of detail doesn’t prevent fraud, but it’s a big win for accountability and internal audits.

How It Works

Digital check encryption relies on two key pieces of software:

The first piece of software integrates directly with the business’s accounting and check printing software. It automatically pulls the relevant data—payee, amount, date, memo, and more—and figures out where to print the encrypted barcode (or “Seal”) on the check. Once installed, the process is fully automated. Every check printed through the system includes its own unique encrypted Seal, with no extra steps required from the user.

The second component is SQN’s image analysis software, used by banks during check processing. When a check is deposited, this software scans the physical check and decodes the encrypted Seal. It then compares the contents of the barcode to the actual printed information on the check image. If anything doesn’t match, whether it’s the payee, amount, or even the date, the check is flagged immediately.

No issue files. No daily uploads. No manual matching. Just fast, automated fraud detection built into the check itself.

Is This Just a New Positive Pay System—or Something Better?

On the surface, digital check encryption might sound similar to Positive Pay. Both are used to prevent commercial check fraud. Both compare issued checks against data to detect tampering. But under the hood, they’re built very differently, and those differences matter.

Positive Pay has been the standard for years, but it requires constant upkeep. Clients have to upload daily issue files, some systems dont check payee names, and the review process is often burdensome for the bank. While Positive Pay is effective, there’s a better solution.

SENTRY: Seal™ takes a completely different approach. It embeds all the check data into an encrypted barcode at the moment of printing. That barcode travels with the check and is automatically verified when deposited—no manual steps, no issue files. It’s a closed-loop system with stronger fraud protection and less work for everyone involved. In fact, many businesses use it to strengthen or even replace their existing Positive Pay setup.

How they stack up:

| Feature | Positive Pay | SENTRY: Seal |

| Requires issue file uploads | ✅ | ❌ |

| Manual review needed | ✅ | ❌ |

| Fields validated | Check number, amount, sometimes payee | All critical fields (payee, amount, date, memo, etc.) |

| Fully automated validation | ❌ | ✅ |

| Visible fraud deterrent on check | ❌ | ✅ |

| Tracks audit data (user, printer, timestamp) | ❌ | ✅ |

Final Thoughts

Commercial check fraud isn’t going away, it’s getting more advanced. Businesses still rely heavily on paper checks, and that makes them prime targets. Tools like Positive Pay helped for a time, but the fraud landscape has changed. Defenses need to change with it.

Digital check encryption, through solutions like SENTRY: Seal™, offers a smarter, more secure way forward. It eliminates the gaps that fraudsters exploit, automates the verification process, and adds visible deterrents that stop fraud before it even starts. It’s not just an upgrade—it’s a shift in how check security works.

Hoping fraud won’t happen isn’t a strategy, and relying on outdated systems won’t cut it anymore. Protect your financial institution from commercial account fraud liability and your reputation.

Ready to Learn More?

If you’re interested in dramatically reducing commercial check fraud at your institution, contact SQN Banking Systems to learn how our SENTRY: Seal™ solution can help. It’s already helping community banks and credit unions stay a step ahead of fraudsters with minimal overhead.