Mail Theft, Dark Web Sales, and Counterfeits: Combating Today’s Check Fraud Threats

Check fraud is on the rise, and community banks and credit unions are frequently in the crosshairs. While digital payments have transformed the financial landscape, checks remain a favored target for fraudsters due to vulnerabilities in legacy systems and traditional processes. Criminals continue to innovate, leveraging new methods to exploit checks, and banks must adapt to protect their customers. Let’s explore some of the latest check fraud trends and the best strategies to fight back.

Check Fraud on the Rise

According to the 2024 AFP® Payments Fraud and Control Survey Report, checks remain the most vulnerable payment method, with 65% of organizations reporting check fraud activity. 2022 to 2023, check fraud saw a staggering 31% increase, and the average fraud cost per check deposit for new accounts is up to $43.30, according to the NICE Actimize Fraud Report. These figures highlight the significant financial threat check fraud poses to community banks, which must act quickly to protect their customers and assets.

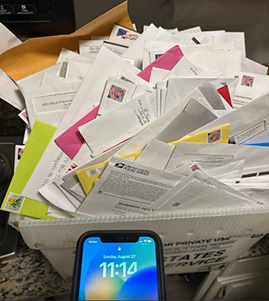

1. Mail Theft and Check Alteration

One of the most common check fraud tactics involves criminals stealing checks from the mail and altering them. This method has exploded in recent years, with FinCEN reporting over $688 million in suspicious activity related to mail-theft check fraud cases.

Many older banking systems struggle to detect altered checks, especially when the check stock is genuine. Criminals can easily change the payee name or dollar amount, slipping these fraudulent checks past detection systems that aren’t equipped to spot subtle alterations.

Solution: Advanced check image analysis systems are vital to combat this. Using handwriting analysis, these systems can detect changes in payee names and dollar amounts. Payee Positive Pay is another powerful tool, automatically comparing issued checks with presented checks to ensure the payee name, check number, and dollar amount match. Any mismatch triggers a fraud alert, helping banks stop fraud before it occurs.

2. Legitimate Checks Sold on the Dark Web

As technology evolves, so do fraud tactics. Criminals are increasingly turning to the dark web to sell legitimate checks for use in fraudulent schemes. What’s even more concerning is how this underground market operates with a business-like efficiency. Criminals have made it disturbingly easy to purchase stolen checks, with listings offering bundles of 45 checks ranging from $1,000 to $100,000 for as little as $2,000 (see below). This black market availability has made check fraud even more accessible to a wider range of bad actors.

Solution: Banks must implement technology that monitors the dark web for stolen account information and check listings. Systems equipped with dark web monitoring can proactively alert banks when their checks or customer accounts appear in these illegal markets. This early warning allows institutions to block stolen checks or freeze accounts before they can be exploited, reducing the risk of fraud.

3. Counterfeit Checks: An Ongoing Threat

While new forms of check fraud have emerged, counterfeit checks remain a serious and ongoing issue. Criminals often use stolen checks as templates to create counterfeit versions, which are then deposited into unsuspecting accounts. According to FinCEN’s analysis of BSA reports, after stealing checks from the U.S. mail, 44% were altered and deposited, 26% were used as templates to create counterfeit checks, and 20% were fraudulently signed and deposited.

Solution: Fixed point analysis is essential in detecting counterfeit checks. This method looks at key security features of check stock—such as the Payor Block, Labels, specific fonts, and security features—and compares them against the customer profile. If something appears unusual or different from a typical customer profile, such as a different font in the payor block, our machine learning module detects potential counterfeiting and generates an alert.

Staying One Step Ahead: The Future of Fraud Prevention for Community Banks

As criminals develop more sophisticated check fraud methods, community banks must stay ahead with comprehensive check fraud prevention software. The landscape of check fraud is evolving, from the ease of buying stolen checks on the dark web to the timeless threat of counterfeit checks. However, the right technology, such as check image analysis, Payee Positive Pay, and dark web monitoring, empowers banks to detect and prevent these attacks.

Fraud prevention is no longer optional—it’s a necessity for maintaining customer trust and protecting financial institutions from the rising costs of check fraud. By investing in modern tools and strategies, community banks can defend themselves against evolving fraud threats and safeguard their customers for the long term.